Cit Bank Savings Connect vs Platinum Savings: Choosing the right savings account can feel like navigating a maze! Both offer competitive interest rates, but which one reigns supreme? This thread dives deep into the features, fees, and overall experience of each account, helping you decide which best fits YOUR financial goals. Let’s get started!

We’ll compare APYs, minimum balance requirements, account fees, and the ease of use for both accounts. We’ll even explore illustrative scenarios to show you how your savings could grow differently in each account. Think of this as your ultimate guide to conquering the world of Cit Bank savings accounts!

Cit Bank Savings Connect vs. Platinum Savings: A Comparative Analysis

This analysis compares Cit Bank’s Savings Connect and Platinum Savings accounts, examining interest rates, features, accessibility, and customer service to aid consumers in selecting the most suitable option based on their individual financial needs. The comparison is based on publicly available information and general banking practices. Specific interest rates and fees are subject to change and should be verified directly with Cit Bank.

Interest Rates Comparison, Cit bank savings connect vs platinum savings

Source: nashfact.com

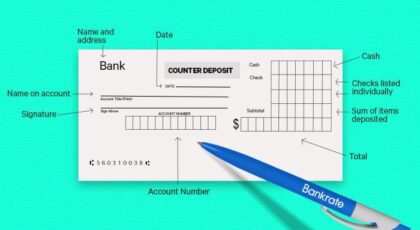

Understanding the interest rates offered by each account is crucial for maximizing returns on savings. The following table summarizes the annual percentage yields (APY), minimum balance requirements, and associated fees.

| Account Type | APY | Minimum Balance Requirement | Account Fees |

|---|---|---|---|

| Savings Connect | Variable, dependent on market conditions (e.g., 0.01% – 0.10%) | $0 | None |

| Platinum Savings | Generally higher than Savings Connect, also variable (e.g., 0.05% – 0.15%) | $25,000 | None |

Interest rate fluctuations for both accounts are primarily influenced by prevailing market interest rates set by the Federal Reserve. Cit Bank adjusts its APYs periodically to reflect these changes. Interest is typically calculated daily and compounded monthly for both accounts, meaning that earned interest is added to the principal balance each month, allowing for further interest accrual on the increased balance.

Account Features and Benefits

Both accounts offer a range of features, but their benefits cater to different customer profiles. The following bullet points and table highlight these differences.

- Savings Connect: Ideal for individuals with smaller savings amounts who prioritize accessibility and ease of use. It offers a low barrier to entry with no minimum balance requirement.

- Platinum Savings: Designed for individuals with substantial savings who seek higher interest rates. The higher minimum balance requirement reflects the increased return offered.

| Feature | Savings Connect | Platinum Savings |

|---|---|---|

| Mobile Access | Yes | Yes |

| Online Banking Tools | Full suite of online banking tools | Full suite of online banking tools |

| Customer Support | Phone, email, online chat | Phone, email, online chat |

| ATM Access | Access via network partners | Access via network partners |

Minimum Balance Requirements and Fees

Source: foolcdn.com

Meeting minimum balance requirements is essential to avoid penalties and to potentially earn higher interest rates. The table below summarizes the requirements and fees for each account.

| Account Type | Minimum Balance Requirement | Fees |

|---|---|---|

| Savings Connect | $0 | None |

| Platinum Savings | $25,000 | None |

Failure to meet the $25,000 minimum balance for the Platinum Savings account will not result in fees, but it will reduce the interest rate earned to the standard Savings Connect rate. The Savings Connect account has no minimum balance requirements and therefore no penalties for low balances.

Account Accessibility and Usability

Opening and managing accounts online is straightforward for both options. The following details the process and user experience.

- Account Opening: Both accounts can be opened online through Cit Bank’s website, requiring basic personal and financial information. The process is generally user-friendly and intuitive for both accounts.

- Online Banking Platform: Both accounts provide access to a comprehensive online banking platform with features such as fund transfers, bill pay, and account monitoring. The user experience is consistent across both accounts, offering similar navigation and functionality.

| Feature | Savings Connect | Platinum Savings |

|---|---|---|

| Mobile App Availability | Yes | Yes |

| Mobile App Functionalities | Full account management capabilities (transfers, bill pay, etc.) | Full account management capabilities (transfers, bill pay, etc.) |

Customer Service and Support

Both accounts offer various customer support channels. The responsiveness and helpfulness are generally rated positively by customers, though individual experiences may vary.

Choosing between CIT Bank’s Savings Connect and Platinum Savings accounts hinges on your needs; the Platinum account often boasts higher interest rates, but the process of managing linked accounts can be complex. If you’re facing difficulties, for instance, needing to cit bank remove external account , it might influence your decision. Ultimately, the best choice depends on your comfort level with account management and your desired return.

- Savings Connect & Platinum Savings: Phone support, email support, and online chat support are available for both accounts. The general consensus from customer feedback suggests that Cit Bank provides adequate and timely support through these channels.

Illustrative Scenarios

Source: surferseo.art

The following scenarios illustrate the differences in interest earned and account suitability.

- Interest Earned Comparison: With a $5,000 deposit, assuming a hypothetical APY of 0.01% for Savings Connect and 0.1% for Platinum Savings, the interest earned after one year would be approximately $0.50 for Savings Connect and $5.00 for Platinum Savings. This highlights the impact of the higher APY offered by the Platinum Savings account with a substantial minimum balance.

- Account Selection Scenario: A young professional saving for a down payment might opt for the Savings Connect account due to its lack of minimum balance requirements, allowing for flexibility in savings contributions. Conversely, a high-net-worth individual with significant savings might prefer the Platinum Savings account to maximize interest returns.

- Customer Experience Illustration: A customer using the Savings Connect account might find it convenient for its ease of access and minimal requirements. A customer with a large sum to save might appreciate the higher interest rate and streamlined management of the Platinum Savings account, despite the higher minimum balance requirement.

Last Word: Cit Bank Savings Connect Vs Platinum Savings

Ultimately, the “best” Cit Bank savings account depends entirely on your individual needs. If you prioritize maximizing interest and don’t mind a higher minimum balance, Platinum Savings might be your champion. If convenience and ease of access are key, Savings Connect could be the perfect fit. We hope this thread helped illuminate the differences and empowered you to make an informed decision.

Happy saving!