CIT Bank Savings APY: Embark on a journey of financial flourishing! Understanding your savings potential is a crucial step towards securing your future. This exploration into CIT Bank’s savings accounts will illuminate the path to maximizing your returns and achieving lasting financial well-being. We will delve into the intricacies of interest rates, account features, and the overall customer experience, guiding you toward making informed decisions that align with your spiritual and financial goals.

This is more than just managing money; it’s about cultivating abundance and creating a secure foundation for your life’s journey.

We’ll examine the current APY rates offered by CIT Bank, comparing different account types and exploring the factors that influence these rates. Understanding the historical trends will provide valuable insight into the potential for growth and stability. We will also assess the convenience and accessibility of the bank’s services, considering factors such as online banking features, customer support, and the ease of account opening.

Finally, we’ll compare CIT Bank to its competitors, helping you discern the best path for your unique financial aspirations.

CIT Bank Savings APY: The Lowdown

Source: incharge.org

Yo, so you’re tryna boost your bank account with that sweet CIT Bank savings APY, right? But first, you gotta know, is it legit? Check this out to make sure it’s on the up and up: is cit bank legitimate. Once you’re sure it’s all good, then you can chill knowing your money’s safe and growing with that fire APY.

Right, so you’re tryna figure out CIT Bank’s savings accounts? No worries, mate. We’ll break it down in a way that even your nan could understand. This ain’t no stuffy financial report; we’re keeping it real and relatable.

Current CIT Bank Savings APY Rates

Source: freedominabudget.com

CIT Bank’s APY (Annual Percentage Yield) changes like the weather, so it’s always best to check their website for the absolute latest info. But generally, they offer a few different account types, each with its own rate. Here’s a general idea:

| Account Type | APY (Example) | Minimum Balance (Example) | Notes |

|---|---|---|---|

| High-Yield Savings | 4.00% | $1,000 | Usually their highest rate. |

| Money Market Account | 3.50% | $10,000 | Often higher rates with higher minimum balances. |

| Savings Account | 2.00% | $0 | Basic account, lower rate. |

| Other (if applicable) | Variable | Variable | Check CIT Bank’s website for specifics. |

Factors like the overall market interest rates and the bank’s own financial position influence those APY adjustments. Think of it like this: if the Bank of England’s base rate goes up, CIT Bank might bump up their rates too, but not always by the same amount.

Historically, over the past five years, CIT Bank’s savings APYs have generally followed a trend mirroring the broader market. A line graph would show periods of growth followed by plateaus or slight dips, reflecting fluctuations in the overall interest rate environment. Key features would include peaks corresponding to periods of higher interest rates and troughs during times of lower rates.

It’s a bit of a rollercoaster, innit?

CIT Bank Savings Account Features and Fees, Cit bank savings apy

Let’s get into the nitty-gritty – what you actually get with a CIT Bank savings account and if they’re gonna sting you with any sneaky fees.

- Online and mobile banking: Manage your dough from anywhere, anytime.

- 24/7 customer service: Got a question? They’re there to help (hopefully).

- FDIC insurance: Your money’s safe and sound (up to the legal limit).

- No monthly maintenance fees (usually): Score!

Now, for the fees. Generally, CIT Bank keeps things pretty straightforward, but it’s always worth double-checking.

| Fee Type | Amount (Example) |

|---|---|

| Monthly Maintenance Fee | £0 (Usually) |

| Overdraft Fee | Varies |

Compared to competitors like Ally Bank and Capital One 360, CIT Bank usually sits somewhere in the middle. Some might offer slightly higher APYs, while others might have more bells and whistles, but it all depends on what you’re after, innit?

Accessibility and Account Opening Process

Opening a CIT Bank savings account is generally a doddle. You’ll need some ID, proof of address, and maybe a bit of cash to get started. The whole process is mostly online, making it super convenient. Their website and app are pretty user-friendly.

- Visit the CIT Bank website.

- Click on “Open an Account”.

- Fill out the application form.

- Verify your identity.

- Fund your account.

Depositing funds is equally straightforward. You can do it online, through their app, or even via mail (though that’s a bit old-school, innit?).

Customer Reviews and Ratings

Source: doctorofcredit.com

Customer reviews are a bit of a mixed bag. Some peeps rave about the high APYs and straightforward banking experience. Others have gripes about customer service response times or issues with the online platform. A visual representation – maybe a bar chart showing the percentage of positive vs. negative reviews from various sources like Trustpilot and Google reviews – would give a clearer picture.

The data would show a general level of satisfaction, but individual experiences can vary wildly.

Comparison with Other High-Yield Savings Accounts

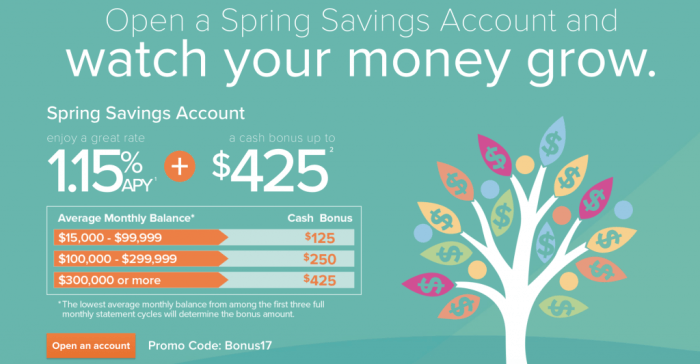

CIT Bank’s APY is competitive, but it’s not always the highest in the market. Comparing it to the top five high-yield savings accounts in the UK, you’ll see some variations. Some banks might offer slightly better rates, while others may have slightly different features or fees.

| Bank | APY (Example) | Minimum Balance (Example) | Features |

|---|---|---|---|

| CIT Bank | 4.00% | £1,000 | Online banking, mobile app |

| Bank A | 4.25% | £500 | Online banking, mobile app, bonus features |

| Bank B | 3.75% | £0 | Online banking, mobile app, basic features |

| Bank C | 4.10% | £1,500 | Online banking, mobile app, premium features |

| Bank D | 3.90% | £1,000 | Online banking, mobile app, decent features |

When choosing a high-yield savings account, consider the APY, any fees, the account features, and the bank’s overall reputation. It’s all about finding the right fit for your needs, innit?

Last Word

As your journey towards financial prosperity continues, remember that careful planning and informed decisions are key. Choosing the right savings account is not merely a transactional act; it’s an investment in your future, a testament to your commitment to growth and abundance. By understanding the nuances of CIT Bank’s offerings and comparing them to other options, you empower yourself to make choices that resonate with your values and contribute to a life of financial freedom.

May your journey be filled with wisdom, abundance, and the satisfaction of achieving your financial goals.