CIT Bank external transfer limits are a crucial aspect of managing your finances effectively. Understanding these limits, how they are determined, and the methods to potentially increase them is key to seamless banking. This exploration delves into the intricacies of CIT Bank’s transfer restrictions, encompassing daily, weekly, and monthly allowances, and the factors influencing these parameters, such as account type, transaction history, and verification status.

We’ll also compare CIT Bank’s policies with those of other major financial institutions, providing a comprehensive overview of the landscape.

This detailed analysis will guide you through the process of requesting higher transfer limits, the necessary documentation, and the expected processing times. We’ll examine various external transfer methods, including wire transfers, ACH transfers, and online transfers, highlighting their respective limits and fees. Security measures implemented by CIT Bank to safeguard against unauthorized transactions and breaches will also be explored, along with troubleshooting strategies for common limit-related issues and reporting suspected fraudulent activities.

Finally, we’ll examine the profound impact of your account history on the limits assigned to your account, and how CIT Bank assesses risk profiles to establish appropriate thresholds.

CIT Bank External Transfer Limits: A Comprehensive Guide

Understanding CIT Bank’s external transfer limits is crucial for managing your finances effectively. This guide provides a detailed overview of these limits, the factors influencing them, methods for increasing them, and how to troubleshoot any related issues. We’ll also explore the different transfer types, security measures, and the impact of your account history on your transfer limits.

CIT Bank’s External Transfer Limits

CIT Bank imposes various external transfer limits based on factors such as account type, account history, and verification status. These limits are typically categorized as daily, weekly, and monthly limits. For instance, a new account might have a lower daily limit than an established account with a strong transaction history. Compared to other major banks, CIT Bank’s limits may vary; some banks offer higher limits, while others may have stricter restrictions.

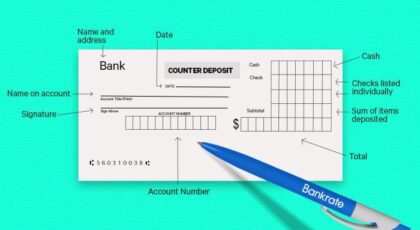

| Transfer Type | Daily Limit | Weekly Limit | Monthly Limit | Fees | Conditions |

|---|---|---|---|---|---|

| Online Transfer | $5,000 (Example) | $10,000 (Example) | $25,000 (Example) | $0 (Example) | Standard account verification |

| Wire Transfer | $10,000 (Example) | $20,000 (Example) | $50,000 (Example) | $25 (Example) | Additional verification may be required |

| ACH Transfer | $2,000 (Example) | $5,000 (Example) | $15,000 (Example) | $5 (Example) | Standard account verification |

Note: These are example limits and fees. Actual limits and fees may vary depending on your specific account and circumstances. Always check your account agreement or contact CIT Bank customer support for the most up-to-date information.

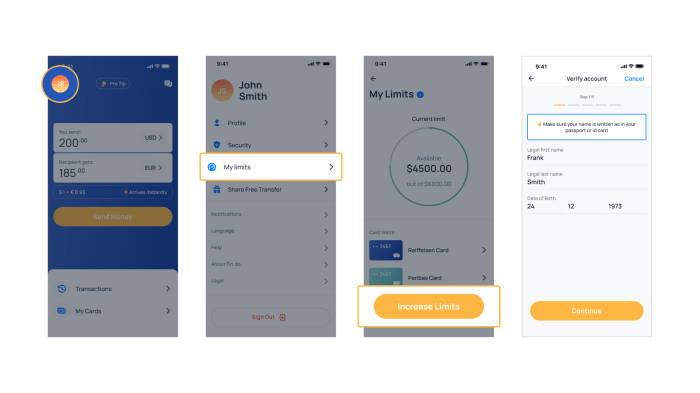

Increasing Transfer Limits at CIT Bank

To request an increase in your external transfer limits, you’ll need to contact CIT Bank’s customer support. This typically involves providing documentation to verify your identity and the source of funds. Supporting documents may include pay stubs, tax returns, or bank statements. The processing time for these requests can vary, but it often takes a few business days.

A request might be denied if CIT Bank identifies inconsistencies or risks associated with your account.

Types of External Transfers and Their Limits

Source: fin.do

CIT Bank supports various external transfer methods, each with its own limits and fees. Understanding these differences is crucial for efficient fund management.

- Online Transfers: These offer convenience and relatively high limits, often subject to daily, weekly, and monthly caps. Fees are typically low or nonexistent.

- Wire Transfers: Faster than online transfers but usually come with higher fees and potentially lower limits depending on the receiving bank.

- ACH Transfers: Electronic transfers processed through the Automated Clearing House network. They are generally slower than wire transfers but often have lower fees and reasonable limits.

Security Measures for Transfer Limits

Source: com.sg

The arbitrary restrictions on CIT Bank’s external transfer limits raise serious questions about transparency and consumer rights. Before even discussing these limitations, one must first grapple with the fundamental question: is CIT a bank ? This seemingly simple question is crucial because the answer dictates the regulatory oversight applicable to these restrictive transfer policies and whether they even legally stand.

Ultimately, understanding CIT’s banking status is vital to addressing the problematic external transfer limits.

CIT Bank employs robust security measures to prevent unauthorized transfers and limit breaches. Multi-factor authentication (MFA) plays a key role, adding an extra layer of security to online transfers. Exceeding transfer limits without prior authorization will trigger alerts and may lead to temporary account suspension pending investigation. For example, if a customer attempts to transfer an amount significantly exceeding their limit, the transaction will be flagged, and the bank will contact the customer to verify the legitimacy of the transfer.

Troubleshooting Transfer Limit Issues

If you encounter issues with your transfer limits, follow these steps:

- Verify your account’s current transfer limits through online banking or by contacting customer support.

- Check for any pending transactions that might be affecting your available transfer amount.

- Review your recent account activity for any unusual or suspicious transactions.

- If you suspect fraudulent activity, immediately report it to CIT Bank’s fraud department.

Contact CIT Bank’s customer support at [Insert Phone Number or Website Link Here] for assistance with transfer limit issues.

Impact of Account History on Transfer Limits, Cit bank external transfer limit

Your account history significantly influences your transfer limits. CIT Bank assesses your risk profile based on factors like transaction frequency, account age, and any history of suspicious activity. A longer account history with consistent, legitimate transactions typically leads to higher limits. Conversely, a shorter history or frequent irregular transactions may result in lower limits.

A visual representation would show a positive correlation between account age and transaction history (represented by a steadily increasing line graph) and the assigned transfer limit (represented by another steadily increasing line graph, reflecting the increase in the transfer limit as account age and transaction history improves).

Final Summary

Navigating the complexities of CIT Bank’s external transfer limits requires a thorough understanding of the various factors involved. From the initial setting of limits based on your account profile to the methods for increasing those limits, each step requires careful consideration. By comprehending the nuances of different transfer types, security measures, and troubleshooting techniques, you can ensure smooth and secure financial transactions.

Remember that proactive engagement with CIT Bank’s customer support can resolve any issues and optimize your banking experience. Mastering these details empowers you to manage your finances with confidence and efficiency within the framework of CIT Bank’s policies.