Cit Bank check deposit offers various methods for depositing checks, each with varying speeds and convenience levels. This guide explores these methods, from the convenience of mobile deposits to alternative options, detailing the process, security measures, troubleshooting steps, and comparisons with other major banks. We will examine fees, limits, and accessibility features, ensuring a complete understanding of Cit Bank’s check deposit services.

Understanding the nuances of Cit Bank’s check deposit system is crucial for efficient banking. This exploration delves into the intricacies of each deposit method, highlighting the advantages and disadvantages of each approach. We will also address common issues and provide solutions, ensuring a smooth and secure check deposit experience for all Cit Bank customers. The information provided aims to empower users with the knowledge to navigate the system confidently and efficiently.

Cit Bank Check Deposit: A Seamless and Secure Experience

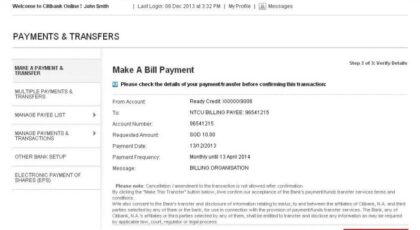

Source: gobankingrates.com

Navigating the world of check deposits can sometimes feel like charting unfamiliar waters. But with Cit Bank, the process is designed to be intuitive, secure, and remarkably convenient. This guide will illuminate the various pathways to depositing your checks, highlighting the advantages and security measures in place to ensure a smooth and worry-free experience.

Cit Bank Check Deposit Methods

Cit Bank offers a variety of methods for depositing checks, catering to diverse preferences and technological comfort levels. Each method boasts its own unique blend of speed and convenience. Understanding these differences will empower you to choose the optimal method for your needs.

Here’s a breakdown of the available options:

- Mobile Check Deposit: Using the Cit Bank mobile app, you can deposit checks directly from your smartphone or tablet. This offers unparalleled speed and convenience, allowing for immediate deposit confirmation.

- In-Person Deposit at Partner Locations: For those preferring a hands-on approach, Cit Bank may have partnerships with physical locations (e.g., retail partners) where you can deposit checks in person. Speed and convenience will vary based on location and availability.

- Mail-In Deposit: While generally slower than other methods, mailing your check directly to Cit Bank remains an option for those who are less comfortable with digital banking. This method requires more time for processing.

| Method | Speed | Convenience | Fees |

|---|---|---|---|

| Mobile Deposit | Near Instant | High | Generally None |

| In-Person Deposit | Same Day or Next Day | Moderate | May Vary by Location |

| Mail-In Deposit | Several Business Days | Low | Generally None |

Mobile Check Deposit Using the Cit Bank App

Mobile check deposit through the Cit Bank app is a remarkably streamlined process. However, adhering to certain guidelines ensures a successful deposit every time. This section details the procedure and offers tips for avoiding common pitfalls.

Endorsing your check correctly is crucial. Simply sign the back of the check, ensuring your signature is clear and legible. The app will guide you through the process of capturing high-quality images of both the front and back of the check. Ensure good lighting and a steady hand for optimal results.

The app will provide clear instructions on image quality. Blurry or poorly lit images are frequent causes of rejection. Avoid shadows and glare for a crisp, clear image.

To avoid common errors, always ensure you have a strong internet connection and sufficient battery life on your device. Double-check the check number and amount before submitting the deposit.

Flowchart: Mobile Check Deposit (Illustrative Description: The flowchart would visually depict the steps: 1. Open Cit Bank app; 2. Navigate to Deposit; 3. Select Check Deposit; 4. Endorse Check; 5.

Photograph Front & Back; 6. Review Details; 7. Submit; 8. Confirmation.)

Security Measures for Cit Bank Check Deposits

Cit Bank prioritizes the security of your check deposits. Robust protocols are in place to protect against fraudulent activity. Understanding these measures will enhance your confidence in the system.

Cit Bank employs advanced fraud detection systems to monitor all transactions. Mobile check deposits undergo rigorous verification processes, including image analysis and comparison against databases of fraudulent checks. This multi-layered approach significantly minimizes the risk of fraudulent activity.

Customers can further enhance security by regularly reviewing their account statements for any discrepancies and reporting suspicious activity immediately. Keeping your banking information confidential and using strong passwords are also crucial.

Streamlining your finances starts with the convenience of a CIT Bank check deposit. Understanding the security measures banks employ is crucial, and this leads us to consider the question: does TD Bank use early warning services, as explored in this insightful article does td bank use early warning services ? This knowledge empowers you to make informed choices about your banking practices, ensuring your CIT Bank check deposit remains secure and efficient.

- Always endorse checks promptly and securely.

- Maintain updated antivirus software on your devices.

- Report any suspicious activity to Cit Bank immediately.

- Never share your banking credentials with anyone.

Troubleshooting Cit Bank Check Deposit Issues

While check deposits are typically seamless, occasional issues might arise. This section addresses common problems and provides solutions to get you back on track.

| Problem | Cause | Solution | Contact Information |

|---|---|---|---|

| Rejected Deposit | Poor image quality, incorrect endorsement, insufficient funds | Resubmit with corrected image or contact customer support | Cit Bank Customer Service |

| Processing Delays | High transaction volume, technical issues | Check account statement; contact customer support if delay is excessive | Cit Bank Customer Service |

Comparing Cit Bank Check Deposit with Other Banks

Source: topmobilebanks.com

To provide context, it’s helpful to compare Cit Bank’s check deposit process with that of other major banks. This comparison will highlight both advantages and disadvantages, allowing for a more informed decision.

- Bank A: (Illustrative Example: Bank A may offer a wider range of in-person deposit locations but have slower mobile deposit processing times.)

- Bank B: (Illustrative Example: Bank B may excel in mobile deposit speed but may have higher fees for certain deposit methods.)

Cit Bank Check Deposit Fees and Limits

Understanding fee structures and deposit limits is crucial for managing your finances effectively. This section clarifies these aspects of Cit Bank’s check deposit services.

| Deposit Method | Daily Limit | Monthly Limit | Fees |

|---|---|---|---|

| Mobile Deposit | (Example: $5,000) | (Example: $20,000) | Generally None |

| Mail-In Deposit | (Example: $2,000) | (Example: $10,000) | Generally None |

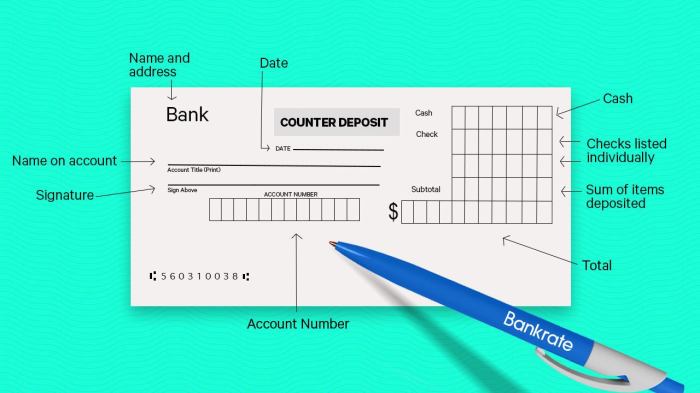

Accessibility of Cit Bank Check Deposit Services

Source: bankrate.com

Cit Bank is committed to providing accessible banking services to all customers. This includes various features and support for those with disabilities or limited technological access.

Cit Bank offers features like screen reader compatibility in their mobile app and website. For customers who require assistance, dedicated customer support representatives are available to guide them through the check deposit process. Alternative methods, such as mail-in deposits, are available for those with limited technological access. Cit Bank also offers various support resources, including FAQs, tutorials, and phone support.

Final Thoughts

Efficient and secure check deposit is a cornerstone of modern banking. This guide has provided a comprehensive overview of Cit Bank’s check deposit options, covering various methods, security protocols, troubleshooting techniques, and comparisons with competitor banks. By understanding the intricacies of each method, including mobile deposit via the Cit Bank app, users can optimize their banking experience, ensuring swift and secure transactions.

Remember to always prioritize security best practices to protect your financial information.