CIT Bank change address? Navigating the process of updating your address with CIT Bank can seem daunting, but with the right information, it’s straightforward. This guide provides a step-by-step walkthrough, covering everything from online updates to potential issues and security considerations. We’ll equip you with the knowledge to smoothly manage your address change and ensure your financial information remains secure.

From understanding the required documentation to exploring different contact methods, we’ll demystify the entire process. We’ll also address potential problems you might encounter, offering practical solutions and preventative measures. Learn how to protect your account and maintain seamless access to your CIT Bank services, even after a change of address.

Understanding CIT Bank’s Address Change Process

Changing your address with CIT Bank is a straightforward process, but understanding the steps involved and potential issues can ensure a smooth transition. This guide Artikels the various methods for updating your address, potential problems you might encounter, and security measures to protect your account.

CIT Bank Address Change Procedures

CIT Bank offers several ways to update your address: online through your account, by mail, by phone, or in person at a branch (if applicable). Each method has its own requirements and advantages.

Required Documentation for Address Update

Generally, you’ll need to provide your current address and your new address. For security purposes, you may also need to verify your identity using information already on file with CIT Bank, such as your account number and date of birth.

Updating Your Address Online

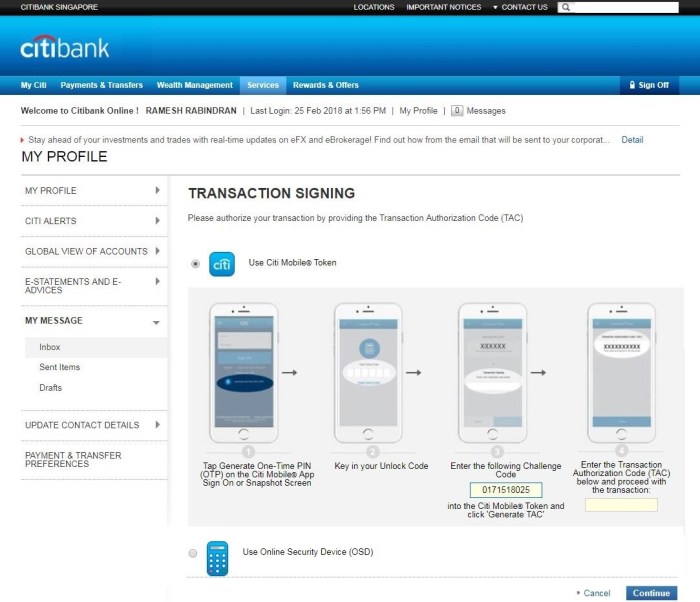

The online method is usually the quickest and most convenient. Log in to your CIT Bank account, navigate to your profile or account settings, and locate the address update section. Follow the on-screen instructions, providing accurate information and verifying your identity as prompted.

Contacting CIT Bank for Address Change

Alternatively, you can contact CIT Bank via phone, mail, or in-person visit. Phone numbers and mailing addresses are readily available on their website. For in-person visits, you’ll need to locate a nearby branch and confirm their availability for address updates.

Comparison of Address Change Methods

| Method | Pros | Cons | Timeframe |

|---|---|---|---|

| Online | Convenient, fast | Requires online access | Immediate to 24 hours |

| Simple, no tech needed | Slowest method | 3-7 business days | |

| Phone | Quick, convenient | May require longer hold times | 1-3 business days |

| In-Person | Instantaneous, assistance available | Requires travel to a branch | Immediate |

Potential Issues and Solutions When Changing Your Address: Cit Bank Change Address

While changing your address is generally simple, several issues can arise. Understanding these potential problems and their solutions can prevent delays and frustration.

Relocating? Don’t forget to update your records with CIT Bank’s new address. If you’re unsure about the procedure, or need any assistance, you can always reach them directly by calling their customer service line; find the cit bank 800 number for immediate help. Remember to confirm your address change with them to avoid any future complications with your accounts.

Common Address Change Problems and Solutions

Incorrect information, such as typos in your new address, is a frequent issue. Processing delays can also occur due to high volume or system errors. If your request isn’t processed correctly, contact CIT Bank immediately using your preferred communication method to report the discrepancy and provide any necessary corrections.

Addressing and Resolving Common Issues

A flowchart would visually represent the process. Start with submitting the address change request. If successful, the process ends. If unsuccessful, check for errors in the provided information. Correct the errors and resubmit.

If the issue persists, contact CIT Bank customer service for assistance. They will investigate and resolve the problem.

Problematic Address Change Scenarios and Avoidance

Scenarios where problems might arise include submitting the request during peak periods or providing inaccurate information. To avoid these, ensure all information is correct before submitting, and consider submitting your request during off-peak hours. Additionally, keep a record of your request, including the date and method used.

Security Implications of Changing Your Address with CIT Bank

Protecting your information during an address change is crucial. CIT Bank employs several security measures to safeguard your data, but you also play a vital role in maintaining your account’s security.

CIT Bank’s Security Measures

CIT Bank utilizes encryption and secure servers to protect your data during transmission. They also employ multi-factor authentication and fraud detection systems to monitor for suspicious activity. However, customer vigilance is still necessary.

Verifying Communication Legitimacy

Always verify the legitimacy of any communication regarding address changes. Never click on links or provide sensitive information in unsolicited emails or messages. Contact CIT Bank directly using their official contact information to confirm any communication you receive.

Reporting Suspicious Activity, Cit bank change address

Source: com.sg

Report any suspicious activity immediately. This includes unsolicited requests for address changes, unusual account activity, or communication from unknown sources claiming to be from CIT Bank. Contact CIT Bank’s fraud department using the contact information provided on their official website.

Best Practices for Account Security

- Use strong and unique passwords.

- Monitor your account activity regularly.

- Be cautious of phishing attempts.

- Keep your contact information updated.

Warning Signs of Fraudulent Address Change Requests

- Unsolicited emails or calls requesting your address.

- Requests for personal information outside of secure CIT Bank channels.

- Urgent or threatening language used in communication.

- Suspicious links or attachments in emails.

Impact of Address Change on CIT Bank Services

Changing your address affects how CIT Bank delivers services and communicates with you. Understanding these impacts can help manage expectations and ensure a smooth transition.

Impact on Statement and Correspondence Delivery

After updating your address, statements and other correspondence will be sent to your new address. Allow a few business days for the change to take effect. You might experience a delay in receiving your first statement at the new address.

Impact on Online Banking and Account Management

Changing your address generally doesn’t affect online banking access or account management. However, ensuring your contact information is up-to-date is crucial for receiving security alerts and important notifications.

Potential Service Delays

There might be minor delays in service while the address change is processed. This delay is usually short-lived, and any impact on service will be minimal. However, it’s advisable to allow sufficient time for the update to fully process.

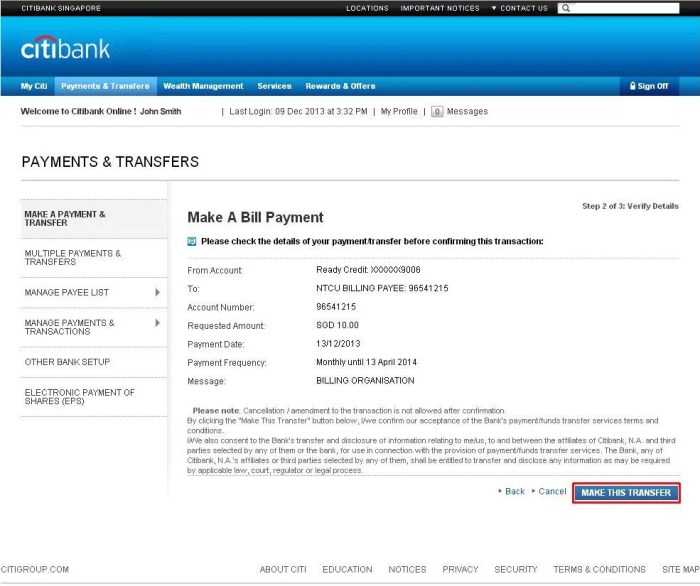

Address Change for Different CIT Bank Services

The process for changing your address is generally consistent across different CIT Bank services, such as checking accounts, savings accounts, and loans. You’ll typically update your address through the same channels (online, phone, mail).

Hypothetical Examples of Address Updates

For example, let’s say John needs to update his address for his checking account. He can log in to his online banking, navigate to his profile settings, and update his address. Similarly, if Mary needs to change her address for her loan, she can call CIT Bank’s customer service or mail in a written request.

Illustrative Examples of Address Change Scenarios

Let’s examine various scenarios to illustrate the address change process and potential challenges.

Successful Address Change

Sarah successfully changed her address online. She logged into her account, updated her address, and received a confirmation email. Her next statement arrived at her new address without issue.

Problem Encountered and Resolution

Source: com.sg

David encountered a problem when he tried to change his address via mail. His request was returned due to an incomplete address. He corrected the information and resubmitted the request, and the address was successfully updated.

Visual Representation of Address Change Steps

Urgent Address Change

If you need to change your address urgently, contact CIT Bank’s customer service immediately via phone. Explain the urgency and provide the necessary information. They can expedite the process to ensure your information is updated as quickly as possible.

Ultimate Conclusion

Successfully updating your address with CIT Bank is crucial for uninterrupted service and account security. By following the steps Artikeld in this guide, and understanding the potential pitfalls and solutions, you can confidently manage this process. Remember to prioritize security and verify all communication. With careful attention to detail, you can ensure a smooth transition and continue to enjoy the convenience of CIT Bank services from your new address.